April's Market Insights

First-time buyers face record prices as sales recover

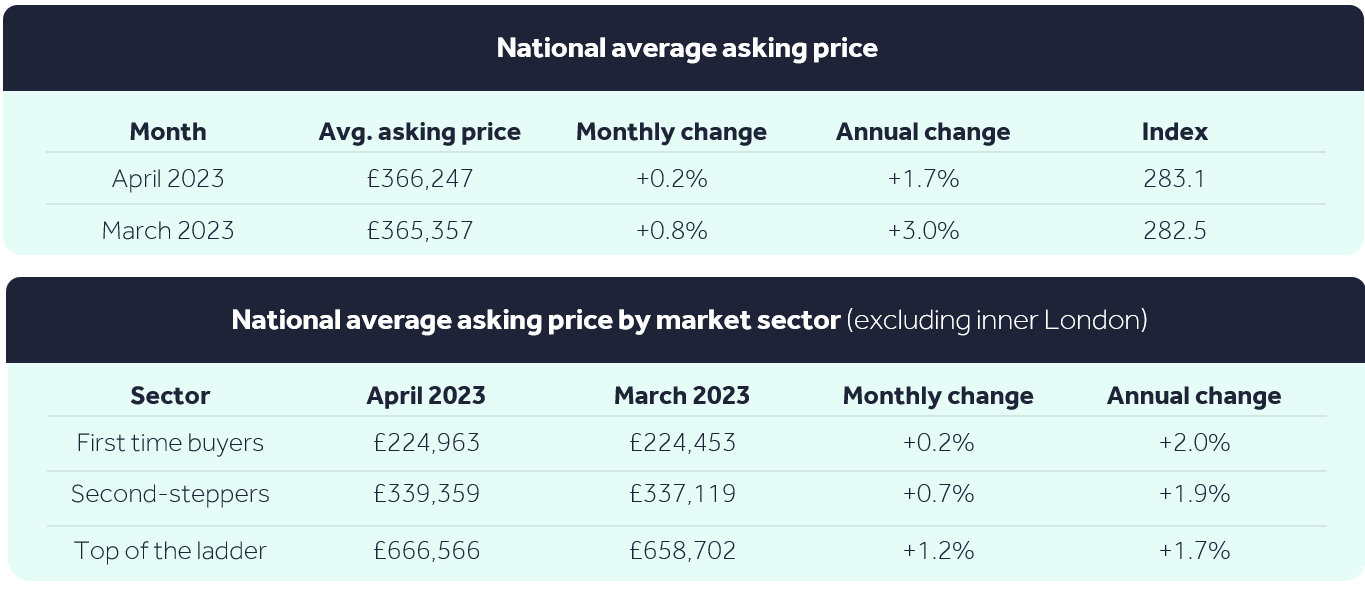

- The average price of property coming to market rises by just 0.2% (+£890) this month, lower than the average of 1.2% at this time of year, as new sellers heed their agents’ advice to price cautiously and tempt Spring buyers

- Despite the economic headwinds, first-time-buyer type properties hit a new record price of £224,963 this month:

- Faced with record rents, buying is still compelling for those first-time buyers who are able to clear the mortgage and deposit hurdles

- The average first-time-buyer mortgage rate for a 5-year fixed, 15% deposit mortgage has now fallen to 4.46%, with the lowest rate for this mortgage type currently at 4.19%

- Sales agreed numbers recover to be in line with the more normal pre-pandemic market of March 2019, and have also exceeded last September’s level, after which they plunged by 21% following the mini-Budget aftershocks:

- The first-time-buyer sector (two bedrooms and fewer) leads this recovery, with agreed sales now 4% higher than in March 2019, while the second-stepper sector remains 4% behind, and the top-of-the-ladder sector 3% behind

- However, sales agreed are still 18% behind last year’s exceptional market as we transition to a more normal level of sales activity

New seller asking prices rise by just 0.2% (+£890) this month to £366,247, which is notably lower than the average increase of 1.2% for this time of year. This unseasonal pricing restraint is a sign that many new sellers are taking note of the economic headwinds and the transitioning of the housing market to a slower pace and more normal activity levels, last seen in the pre-pandemic market of 2019. Whilst it’s been a rollercoaster journey so far, and there will no doubt be more twists and turns to come, the number of sales agreed is now on a par with the same period in 2019. Agreed sales volumes are now just 1% behind March 2019 with the strength of the improvement since the start of the year defying the expectations of many.

“Agents are reporting that many sellers have transitioned out of the frenzied multi-bid market mindset of recent years and understand the new need to tempt Spring buyers with a competitive price. The current unexpectedly stable conditions may tempt more sellers to enter the market who had been considering a move in the last few years but had been put off by its frenetic pace. Buyers may have struggled to find a home that suited their needs in the stock-constrained market of recent years and will now find more choice available. However, those who have now decided to make a move should not wait around too long to make an enquiry if they see the right home for sale, as not only is the number of sales agreed now back to pre-pandemic levels, but homes are also on average selling twelve days more quickly than at this time in 2019.“

Tim Bannister Rightmove’s Director of Property Science

One of the dips in this market rollercoaster was the fallout from the mini-Budget towards the end of September, with sales agreed initially plunging by 21% the following month as mortgage interest rates rapidly accelerated. Further highlighting the recovery, monthly sales agreed volumes are now higher than in September for the first time since the mini-Budget took place. However, sales agreed are still 18% behind last year’s exceptional market as we transition to a more normal level of sales activity.

Leading the recovery to pre-pandemic sales levels is the first-time-buyer sector (two-bedroom and fewer properties) with sales volumes in this sector now 4% higher than in March 2019. By contrast the sectors with larger homes, the second-stepper and top-of-the-ladder sectors, are still 4% and 3% behind 2019 respectively.

First-time-buyer type properties have reached a new record price of £224,963 this month, which may appear surprising given the economic headwinds that have made taking out a mortgage more expensive and saving up for a deposit even more challenging. However, solid buyer demand in this sector which is now 11% higher than in the same period in 2019, illustrates the continued strong desire from would-be first-time buyers to own their own home. This is even more understandable given the fiercely competitive rental market, with soaring rents reaching new records and making buying compelling for those who can raise the deposit and obtain a mortgage.

Some good news for first-time buyers is that average mortgage rates have been falling over the last few weeks, with lender competition to secure business now strongest in the traditional first-time buyer loan-to-value ranges of 85% and 90%. Whether this trajectory will be affected by the latest inflation figures remains to be seen. With more competitive rates on offer for first-time buyers, more may be encouraged to take the leap now, The average mortgage rate for a 5-year fixed, 15% deposit mortgage is currently 4.46%, with the lowest rate for this mortgage type standing at 4.19%. This has edged down from an average of 4.65% a month ago, but it is still much higher than the average rate of 2.64% at this time last year.

“The first-time-buyer sector typically accounts for over a third of all sales which are often the start of chains, so these positive sales agreed figures are good for the health of the whole market. The current multi-speed market is highlighted by sales of larger homes continuing to lag behind, with some sellers in the upper sectors likely needing to show a greater degree of pricing restraint to attract buyers in this much more price-sensitive market. More competition amongst lenders in the smaller deposit, higher loan-to-value ranges is positive news for those would-be first-time buyers who have saved up their deposit and can still afford to move. However, it remains a challenging environment to get onto the ladder, with new record average asking prices and higher borrowing costs to budget for than a year ago.“

Tim Bannister Rightmove’s Director of Property Science

|

Click Here to read the House Price Index |

April's Market Insights

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024