August's Market Insights

Bank Rate cut spurs further upturn in market activity

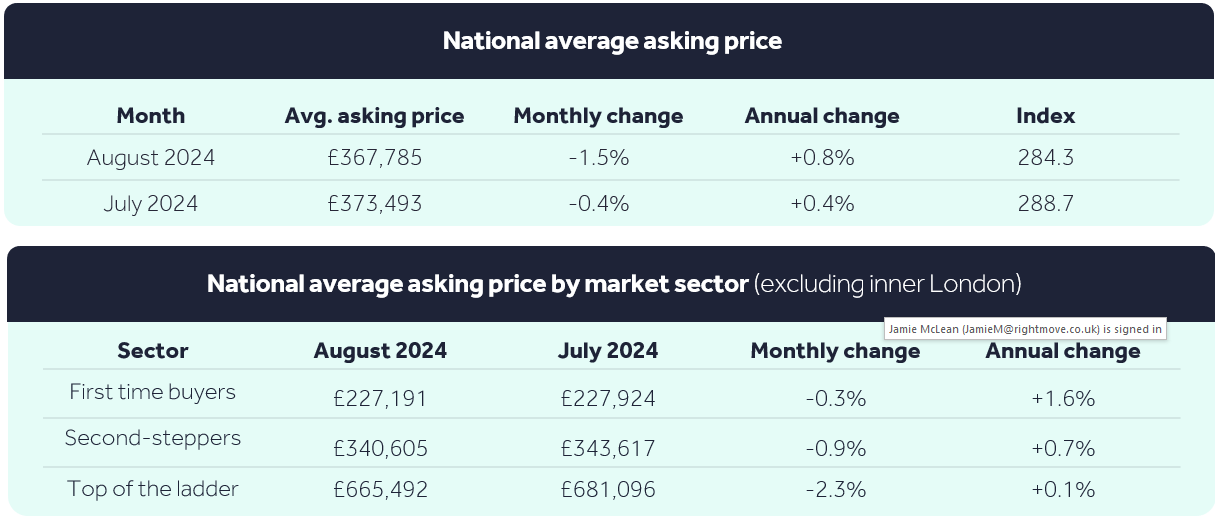

- Average new seller asking prices see a seasonal drop of 1.5% (-£5,708) this month to £367,785. August has seen a monthly decline in prices from July for the last 18 years, with this month’s fall in line with the long-term average

- The first Bank of England rate cut for four years has led to an immediate upturn in buyer activity:

- The number of potential buyers contacting estate agents about homes for sale has jumped from 11% up on the prior year across the month of July, to 19% up since the 1st of August compared to the same time a year ago

- Rightmove raises its 2024 forecast from -1% to +1% due to positive market data and trends compared to the much more subdued 2023:

- The number of sales being agreed is now 16% ahead of the near-peak-mortgage-rate period of a year ago

- The number of new sellers coming to market is 5% ahead of last year as confidence to move grows

- Rightmove’s weekly mortgage tracker shows that the average 5-year fixed mortgage rate is now 4.80%, an improvement from 5.82% a year ago:

- The best available 5-year fixed rate is now 3.83% for those with a 40% deposit, the lowest a 5-year fixed rate has been since the period before the mini-Budget in September 2022

The average price of property coming to the market for sale sees a seasonal drop of 1.5% this month (-£5,708) to £367,785. New seller asking prices have fallen in the month of August for the past 18 years, and the size of this month’s drop is in line with the long-term average. The distractions of school summer holidays traditionally bring a dip in prices, as some buyers put their home-moving plans on hold to enjoy holidays or time with family. This also means that new sellers who do come to market at this quieter time of year may have a pressing need to sell, which means they tend to price more competitively. However, summer sellers this year may find that there is a degree of buyer buzz around the market that was missing in the peak-mortgage-rate market at this time last year. As anticipated in Rightmove’s July report, the first Bank of England rate cut for four years at the start of the month has helped to accelerate mortgage rate drops and contributed significantly to improved buyer demand. These better conditions are helping to set up a positive Autumn market, and a further spur to activity following the Bank Rate cut has led Rightmove to raise its 2024 forecast from a 1% drop over the whole of 2024 to a 1% rise in new seller asking prices.

“The first Bank Rate cut since 2020 has sparked a welcome late summer boost in buyer activity. While mortgage rates aren’t yet substantially lower since the rate cut, the fact that the long-hoped-for first cut has finally arrived, and mortgage rates are heading downwards, is positive for home-mover sentiment. As the summer holiday season comes to an end, the conditions are there for a more active autumn market. The reaction from home-movers to what is hopefully only the first of several rate cuts over the next year or two, combined with other positive data and trends, has led us to raise our price prediction for the year. We now expect new seller prices to rise marginally by 1% over the whole of 2024. This is a relatively small revision from our original prediction of a 1% fall in prices over the year, since we didn’t initially forecast anything more drastic than a slight drop in prices this year.”

Tim Bannister Rightmove’s Director of Property Science

Since the Bank Rate cut on the 1st of August, the number of potential buyers contacting estate agents to view homes for sale is 19% higher than in the same period a year ago. This comparison is with a very subdued period in 2023, when the market was dealing with the fallout of unexpectedly high inflation figures and peak mortgage interest rates. However, this improvement in the buyer demand trend from +11% across the month of July shows the immediate and strong impact of the first Bank Rate cut since 2020. Agents report that increased political certainty and the improving economic outlook is also helping with buyer interest.

The positive impact of the Bank Rate cut, combined with other encouraging market data, has led Rightmove to revise its end-of-year price prediction upwards — from a 1% drop in new seller asking prices over the whole of 2024, to a 1% rise over the year. We expect small price rises in the autumn, followed by the usual seasonal monthly falls in prices at the end of the year. Though there are still some uncertainties ahead – October’s Budget, the timing of a second Bank Rate cut, and the US economy to name just three – the scene is now set for a positive remainder of the year. The number of sales being agreed between buyers and sellers continues to track very positively at 16% ahead of last year, and the number of new sellers coming to market is now a stable 5% ahead of this time last year.

Mortgage rates continue to head downwards and have picked up some pace in recent weeks. The average five-year fixed mortgage rate is now 4.80%, which though still high compared with three years ago, before the first of 14 consecutive Bank Rate increases, is an improvement from 5.82% at this time in 2023. Rightmove’s weekly mortgage tracker shows that the best available 5-year fixed rate is now 3.83% for those with a 40% deposit, the lowest that a 5-year fixed rate has been since the period before the mini-Budget in September 2022.

“Although it will likely take a few more cuts to the Bank Rate for home-movers to see a more substantial reduction in mortgage rates, it’s home-mover sentiment that has immediately been heightened. Buyers and sellers are more optimistic about the outlook for the market, evidenced by the immediate upturn that we’ve seen in activity. However, though optimism around the direction of mortgage rates is justified, the reality is that they are still very high compared with a few years ago, and there will be some who need rates to drop further before their affordability is notably improved. Buyers are still stretched, and so sellers mustn’t get too carried away by the higher buyer activity levels compared with last year, and continue to come to market with a competitive price.”

Tim Bannister Rightmove’s Director of Property Science

|

Click Here to read the House Price Index |

August's Market Insights

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024